- #Formula for inventory turnover ratio how to#

- #Formula for inventory turnover ratio software#

- #Formula for inventory turnover ratio plus#

The better you are at estimating what customers will want and when, the more effectively you can manage how many products you need to keep in stock at certain times of the year.

#Formula for inventory turnover ratio how to#

How to improve inventory turnover Accurate forecasting But it’s important to remember that these are industry-wide averages, so you should use them only as guides. So what is a good inventory turnover ratio for your business? The financial sector typically has the highest median inventory turnover ratio of about 30, for the retail sector it’s about 7 and for the technology sector it’s about 11. But at the same time, if the ratio is too high it can suggest insufficient inventory to support sales at that rate.

“A higher inventory turnover ratio is something that all businesses should aim towards as it shows that your products are well-received by your customers, you are forecasting demand accurately, and reordering stock at the correct level,” says Iswaran. In contrast, businesses that sell affordable products with a shorter shelf life will have a higher ratio, he adds. Inventory turnover in days: 365 / 4 = 91 days What is a good inventory turnover ratio?Ī healthy inventory turnover ratio is different for each industry but, in general, businesses that sell more expensive products with a longer shelf life will have a lower inventory turnover ratio, explains Iswaran.

Inventory turnover in days: 365 / Inventory turnover

This means Company A sold its stock four times in one year.įrom here you can also calculate how many days it takes to sell your inventory once. Here’s how to calculate inventory turnover ratio: Company A had COGS of £200,000 in 2021 and its average inventory value was £50,000.

#Formula for inventory turnover ratio plus#

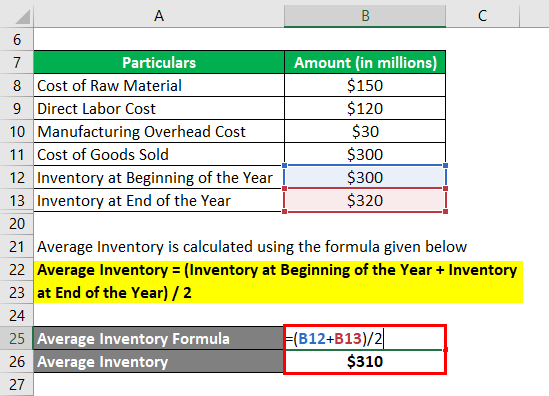

It takes the beginning inventory balance plus the ending inventory balance and then divides it by the given time period.Īverage inventory = Beginning inventory + Ending inventory / Number of time periods This is the average value of your inventory over two or more specified periods of time. This includes labour, raw materials, shipping and administration costs.ĬOGS = (Opening inventory + net costs) – Closing inventory Average inventory Cost of goods sold (COGS)ĬOGS is a measure of all the direct expenses involved in making or delivering a product or service. Let’s take each component of the inventory turnover ratio formula and look at them in more detail. Inventory turnover ratio = COGS / Average inventory The inventory turnover ratio formula divides the cost of goods sold (COGS) by average inventory for the same period. For example, an inventory turnover ratio of two calculated over a one-year period indicates that a company sold its inventory twice in one year. The inventory turnover ratio formula determines the number of times inventory is purchased and sold during a given period, typically a year. How do I calculate inventory turnover ratio? As such, calculating the inventory turnover ratio is an important part of financial analysis activities. A lower inventory turnover ratio for example, can provide valuable insights on problem areas that you can work on fixing, says Iswaran, such as avoiding overstocking, ensuring product fit, selling to the right customers and setting reasonable prices. Tracking the inventory turnover ratio therefore allows business owners to identify whether they need to make adjustments to pricing, marketing or other areas to increase sales or better manage stock levels. But at the same time, having a surplus of products that cannot be sold means that cash, which could be invested elsewhere in the business, is being locked away in unsold products and storage costs. Why is inventory turnover ratio important?īusinesses can miss out on potential sales if there is not enough inventory. One complete turnover of inventory means a company has sold all of the stock it has purchased. It considers the amount of time that passes from the day an item is purchased as stock by a company, until it is sold to the end consumer or client. Inventory turnover refers to how fast or how many times you can sell your products over a given time period, and is a measure of how efficiently a company manages its stock. Here’s a closer look at what the inventory turnover ratio means, how to calculate it and, importantly, how to improve it. Monitoring how much stock you sell and how quickly can support business owners in more effectively managing stock levels against demand and ensuring its sales and marketing activities are working.

#Formula for inventory turnover ratio software#

“Inventory turnover ratio provides insights into your sales, marketing, pricing, product demand and purchasing,” says Sivaramakrishnan Iswaran, global head of finance and operations at inventory management software business, Zoho.

0 kommentar(er)

0 kommentar(er)